2 Tax Credits Just for Small Businesses May Reduce Your 2017 and 2018 Tax Bills

Tax credits reduce tax liability dollar-for-dollar, potentially making them more valuable than deductions, which reduce only the amount of income subject to tax. Maximizing available credits is especially important now that the Tax Cuts and Jobs Act has reduced or…

Can You Deduct Home Office Expenses?

Working from home has become commonplace. But just because you have a home office space doesn’t mean you can deduct expenses associated with it. And for 2018, even fewer taxpayers will be eligible for a home office deduction. Changes under…

Personal Exemptions and Standard Deductions and Tax Credits, Oh My!

Under the Tax Cuts and Jobs Act (TCJA), individual income tax rates generally go down for 2018 through 2025. But that doesn’t necessarily mean your income tax liability will go down. The TCJA also makes a lot of changes to…

Tax Cuts and Jobs Act: Key Provisions Affecting Individuals

On December 20, Congress completed passage of the largest federal tax reform law in more than 30 years. Commonly called the “Tax Cuts and Jobs Act” (TCJA), the new law means substantial changes for individual taxpayers. The following is a…

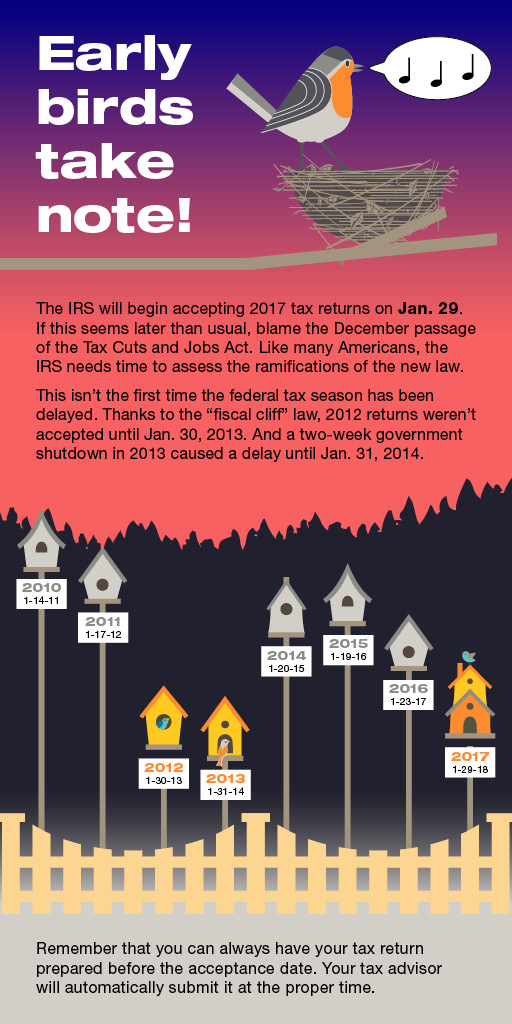

Don’t Be a Victim of Tax Identity Theft: File Your 2017 Return Early

The IRS has just announced that it will begin accepting 2017 income tax returns on January 29. You may be more concerned about the April 17 filing deadline, or even the extended deadline of October 15 (if you file for…

The TCJA Temporarily Expands Bonus Depreciation

The Tax Cuts and Jobs Act (TCJA) enhances some tax breaks for businesses while reducing or eliminating others. One break it enhances — temporarily — is bonus depreciation. While most TCJA provisions go into effect for the 2018 tax year,…

401(k) Retirement Plan Contribution Limit Increases for 2018

Retirement plan contribution limits are indexed for inflation, but with inflation remaining low, most of the limits remain unchanged for 2018. But one piece of good news for taxpayers who’re already maxing out their contributions is that the 401(k) limit…

What You Need to Know About Year-End Charitable Giving in 2017

Charitable giving can be a powerful tax-saving strategy: Donations to qualified charities are generally fully deductible, and you have complete control over when and how much you give. Here are some important considerations to keep in mind this year to…

Even If Your Income is High, Your Family May Be Able to Benefit From the 0% Long-Term Capital Gains Rate

We’re entering the giving season, and if making financial gifts to your loved ones is part of your plans — or if you’d simply like to reduce your capital gains tax — consider giving appreciated stock instead of cash this…